The EPF scheme has catered to over 5 Crore individuals and is directed by three different Acts namely the Employees Provident Fund Scheme Act 1952 the Employees Deposit Linked Insurance Scheme Act 1976 and the Employees Pension Scheme Act 1995. The Employees Provident Fund Organisation operates three schemes.

What Happens To Ppf And Epf When You Become An Nri Mint

An EPF calculator is an online calculator that helps you to find the exact amount of money that will be accumulated in your EPF account.

. However the rate of returns in case of such schemes is limited. The Employees Provident Fund Organisation EPFO manages the EPF. So you dont need to pay a premium or contribute to EDLI.

Employees Provident Fund EPF is a scheme that is regulated by the Employees Provident Fund Organisation EPFO and it was introduced due to the Employees Provident Funds and Miscellaneous Provisions Act 1952. The lump sum withdrawal from. The Insurance Scheme 1976.

Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. For the financial year 2021 the Employee Provident Fund interest rate is set at. The review of the EPF interest rate for a financial year is set at the end of the financial year.

An Act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. Over the career time one shifts a job multiple times. The Pension Scheme 1995.

FinacBooks is an Indian portal of Chartered Accountants CAs and Real Estate Agents with more than 10 years of experience in offering accounting financial taxation and real estate related services to individuals builders developers and business owners. All you need to do is visit the EPF calculator page enter your current age basic monthly salary and dearness allowance and your contribution to EPF account with accrued interest. The EPF Scheme 1952.

The fund is built with monetary contributions extended by employees and their employers each month. EPF can be a good investment plan as it also. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia.

Any organisation or firm with 20 or more employees gets covered under the EPFO. In case of lump sum withdrawal the lesser the number of years of service the lower the amount a person will receive. The registered nominee receives a lump-sum payment in the event of the death of the person insured during the period of the service.

EPF is a beneficial scheme for investors who are looking to guaranteed returns. Akta A1300 BE IT ENACTED by the Duli Yang Maha Mulia Seri Paduka Baginda Yang di-Pertuan Agong with the. How Much Can a Person Withdraw from EPS Account.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. EMPLOYEES PROVIDENT FUND ACT 1991. EPF comes under Employee Provident Fund and Miscellaneous Provisions Act1952.

EPF EPF Pension Scheme EPS And EPF Insurance EDLI Employees Deposit Linked Insurance Scheme or EDLI is an insurance cover provided by the EPFO. The work culture today depends on the welfare of employees with employers scrambling to. Income Tax Calculator India in Excel FY 2021-22 AY 2022-23 Calculators Budget Budget 2020 Income tax Investment Plan Taxes.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. On the other hand market-linked investment schemes like Mutual Funds can generate a considerable amount of gains. But the benefit of this scheme is added continuously under UAN.

A revenue stamp of Re 1 needs to be pasted with the EPF Form 10C. The employees who fall under the EPF scheme make a fixed. EPF is an excellent saving scheme for building a sufficient retirement corpus for salaried employees.

The Employees Provident Fund Organization EPFO Central Board of Trustees after consultation with the Ministry of Finance reviews the EPF interest rates every year. The EPF calculator will tell you the exact amount that will. As per the EPF act 1952 any person who retires after completing service of 58 years minimum is eligible to withdraw the full PF amount and claim the EPS amount.

Eligibility for EPF Registration.

Grow Your Wealth With Unit Trust

The Magic Of Compounding Interest

Pelaburan Public Mutual Guna Akaun 1 Kwsp Myrujukan

Public Mutual Bangsar Utama 11 15 Jalan Bangsar Utama 3

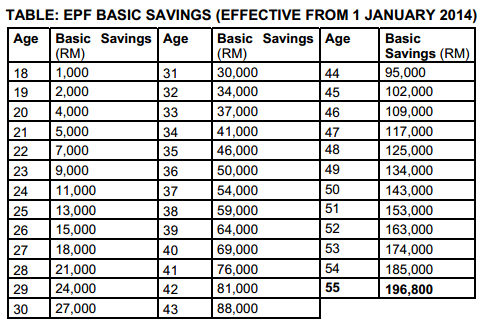

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

Public Mutual Pocket Calculator From Public Mutual Facebook

Diversify Your Retirement Nest Egg

Public Mutual Fund Random Thoughts

Uneedtrust Where Trust Is Mutual

Cara Memulakan Pelaburan Unit Trust Public Mutual

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

Public Mutual Declares Rm141m Dividend Mypf My

How To Invest Public Mutual Fund Using Epf Malaysia Financial Blogger Ideas For Financial Freedom

Public Mutual Declares Distributions Of Rm66m For 10 Funds The Star

Kita Boleh Keluarkan Public Mutual Unit Trust Consultant Facebook

Pelaburan Public Mutual Guna Akaun 1 Kwsp Myrujukan

Public Mutual No 1 Home Facebook

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com